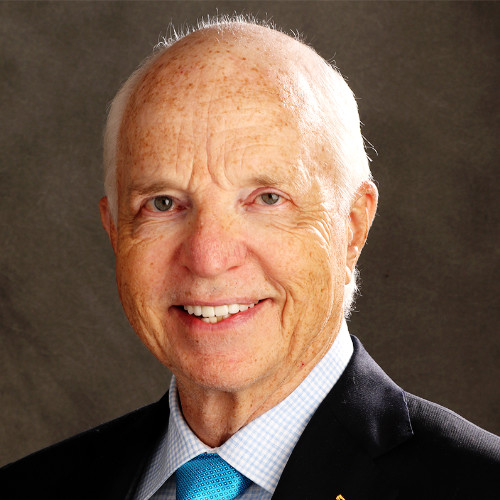

The timing of President Trump’s Tax Cut and Jobs Act – coinciding with the most synchronised global economic recovery since the 1950s – will boost company earnings globally during 2018, despite recent market volatility, says John Tobin, portfolio manager with US-based Epoch Investment Partners.

“The variability in GDP growth across countries is at its lowest point in over 50 years. This solid global growth cycle is a major positive for economies and company earnings growth.

“Capex has rebounded strongly, and US export and industrial production have risen significantly. Meanwhile, we are expecting the transition globally, from quantitative easing to quantitative tightening, to be slow, gradual and well telegraphed.

“In fact, despite anticipated QE measures, financial conditions will remain extremely loose. In the US, the Fed’s financial stress indicators suggest markets are still awash with liquidity.”

To read the media release, click here.