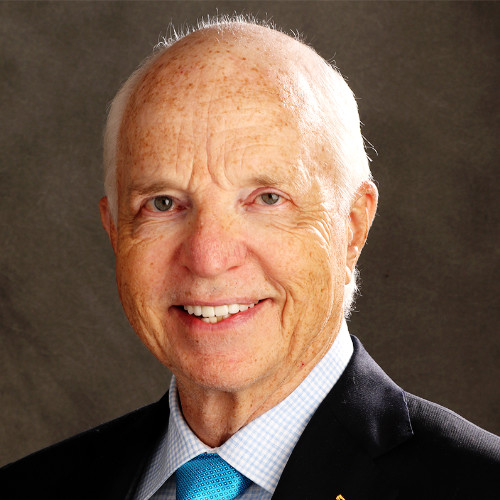

The following was penned by GSFM Investment Consulting Strategist, Stephen Miller:

This is a ‘whatever it takes’ moment for Australia and, indeed, the rest of the world. Former RBA Governor Glenn Stevens’ had a dictum: “first do no wrong”. In the current circumstance that means erring on the side of excess when it comes to stimulus.

The June quarter is likely to see the biggest ever quarterly decline in Australia’s GDP probably since the Great Depression. And that by a significant margin. The challenge is to make the period of negative growth as short as possible. In this sense Australia is fortunate that it does have fiscal firepower. However, the way that firepower is deployed is vitally important in order to mitigate what is certainly in an economic sense, and in other ways, going to be the most challenging 6+ months, for many of us, in our lifetimes.

In this sense the RBA measures are a welcome and positive step involving as they do innovative approaches to monetary policy through QE and the Term Funding Facility. But they may be just another instalment. Only time will tell. I think it is implicit in the RBA’s statement today that they stand ready to do more if needed. They may need to be a little more explicit a la Draghi’s ‘whatever it takes’ at some point.

To read the media release, click here.