The outlook for global and Australian markets is positive, according to GSFM and its fund manager partners Munro Partners and Tribeca Investment Partners. They say markets are supported by easy monetary conditions, ongoing fiscal support and global economies which continue on a path towards normality as COVID-19 vaccines are rolled out and the lagged impacts of social restrictions unwind.

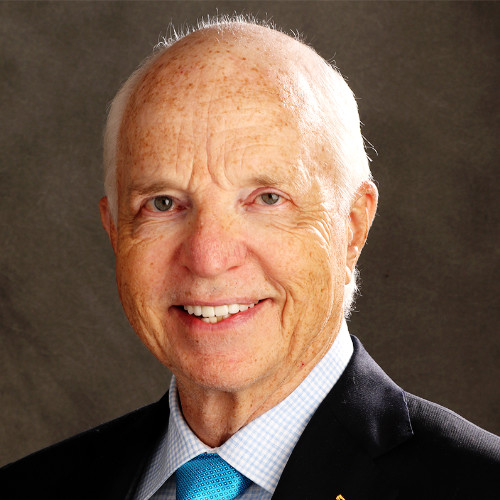

GSFM Investment Strategist, Stephen Miller, says markets appear to have priced in a relatively cheery narrative for 2021, but that quiescent inflation is pivotal to that view.

“While ever inflation is quiescent, bond yields remain anchored to their current levels and equity valuations remain well within the realm of plausibility. And it is difficult to conceive of inflation as an imminent threat even with historically extreme levels of monetary accommodation. However, inflation is a medium-term risk and one that bond markets are beginning to focus on.

“Risk markets, however, appear to have become largely inured to the notion that there is any prospect of inflation on the horizon.

“The biggest inflation threat arises from the reversal of the two great structural trends that account for the deflationary tendency of the past three decades: globalisation of labour supply (as well as that for goods and services) and baby boomer workforce participation. Both are on the cusp of reversing.”