Epoch Global Equity Shareholder Yield (Unhedged) Fund

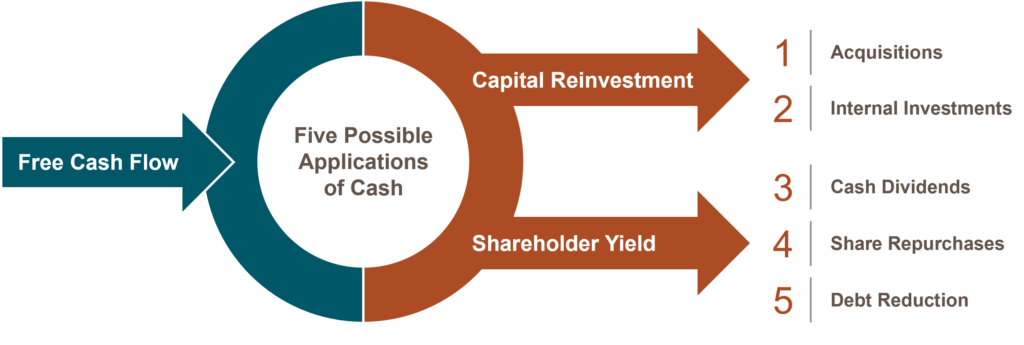

The Fund pursues attractive total returns with above-average levels of income by investing in a diversified portfolio of global companies with strong and growing free cash flow.

Fund Overview

The Fund is designed to seek attractive total returns with an above average level of income from a diversified portfolio of global companies that are sustainably growing their free cash flow year after year, and returning that cash to shareholders through consistent or increasing dividends, share buybacks and debt reduction. Epoch defines these uses of free cash flow as ‘shareholder yield’.

Before making an investment, Epoch analyses a company as if it were looking to purchase the entire business. The Fund invests in businesses with understandable operating models, transparent financial statements, and a proven ability to generate free cash flow.

By actively seeking companies with strong shareholder yield characteristics, Epoch’s goal is to construct a portfolio that will achieve a higher level of yield than other income options, as well as capital growth.

This can be particularly important in a retirement portfolio; capital appreciation can help boost assets in the accumulation phase, and help sustain a portfolio during the drawdown phase.

Entry and exit prices are available here.

QUICKLINKS

FUND FACTS

- APIRGSF0002AU

- mFund codeGSF02

- Inception date15 May 2008

- DistributionsQuarterly

- Fund size at 30.06.2024$1,065.04 M

- Units on issue at 30.06.2024847.52 M

HOW TO INVEST

Investment can be made using the Fund’s PDS, via mFund or through key platforms, including:

- AMP Hillross Portfolio Care

- AMP Flexible

- AMP MyNorth

- AMP North

- ANZ Grow Wrap

- Asgard

- AUSMAQ

- Beacon

- BT Panorama

- Colonial FirstChoice

- Colonial FirstWrap

- Colonial CFS Edge

- Ensurity Super

- HUB24

- IOOF

- Macquarie Wrap

- Mason Stevens

- MLC Navigator

- MLC Wrap

- Netwealth

- Oasis

- Optimum

- Platform One

- PowerWrap

- Praemium

- Summit

- Suncorp WealthSmart

- uXchange

- Wealthtrac

- Xplore Wrap

TERMS & CONDITIONS

BY CLICKING ON ‘I AGREE’, I DECLARE I AM A FINANCIAL SERVICES LICENSEE AS DEFINED IN THE CORPORATION ACT 2001.

What is a financial services licensee? A person or entity is a financial services licensee if they hold an Australian financial services licence issued pursuant to the Corporations Act 2001.

Portfolio Value of $10,000 Invested

Epoch Global Equity Shareholder Yield Fund (Unhedged) Performance

| As at 30 June 2024 |

Month % | 3 Months % | 1 Year % | 3 Years % p.a. | 5 Years % p.a. | 7 Years % p.a. | 10 Years % p.a. | Since Inception1 % p.a. |

|---|---|---|---|---|---|---|---|---|

| Fund2 | 0.11 | (0.90) | 12.75 | 9.92 | 7.93 | 8.04 | 8.49 | 7.79 |

| Benchmark3 | 1.61 | 0.31 | 19.92 | 11.18 | 13.01 | 13.19 | 13.13 | 9.64 |

| Over / (Under) | (1.50) | (1.21) | (7.17) | (1.26) | (5.08) | (5.15) | (4.64) | (1.85) |

Epoch Global Equity Shareholder Yield Fund (Unhedged) Performance Components

| As at 30 June 2024 |

Month % | 3 Months % | 1 Year % | 3 Years % p.a. | 5 Years % p.a. | 7 Years % p.a. | 10 Years % p.a. | Since Inception1 % p.a. |

|---|---|---|---|---|---|---|---|---|

| Distribution4 | 7.17 | 7.10 | 9.15 | 8.33 | 7.62 | 8.02 | 7.90 | 6.25 |

| Growth | (7.06) | (8.00) | 3.60 | 1.59 | 0.31 | 0.02 | 0.59 | 1.54 |

| Total | 0.11 | (0.90) | 12.75 | 9.92 | 7.93 | 8.04 | 8.49 | 7.79 |

1 15 May 2008

2 Fund returns are calculated net of management fees and assuming all distributions are reinvested

3 MSCI World ex-Australia Index in $A, net dividends reinvested*

Past performance is not a reliable indicator of future performance.

*All data is the property of MSCI. No use or distribution without written consent. Data provided “as is” without any warranties. MSCI assumes no liability for or in connection with the data.

IMPORTANT INFORMATION

This material has been provided for general information purposes only and must not be construed as investment advice. This material has been prepared without taking account of the objectives, financial situation or needs of individuals. Before making an investment decision in relation to a Fund, investors should consider the appropriateness of this information, having regard to their own objectives, financial situation and needs, and read and consider the product disclosure statement (PDS) for the Fund prior to making any investment decision. The PDS is available on this website or by calling 1300 133 451.

Past performance information provided on this website is given for illustrative purposes only and should not be relied upon as (and is not) an indication of future performance. Investing involves risk including loss of capital invested. None of GSFM Responsible Entity Services Limited, its related bodies or associates nor any other person guarantees the repayment of capital or the performance of the Fund or any particular returns from the Fund. Please click on this link to read the disclaimers in full.

Investment Team

FUND AT A GLANCE

- A diversified portfolio of 90-120 global companies with attractive income and capital growth potential

- Risk management seeks to achieve the least possible volatility for the return characteristics sought

- Complements other global equity strategies that primarily focus on traditional valuation methods and capital appreciation

- Suitable for investors seeking income; generally provides a tax-effective income (yield + low turnover)

- Highly regarded by research houses

Read | Watch | Listen