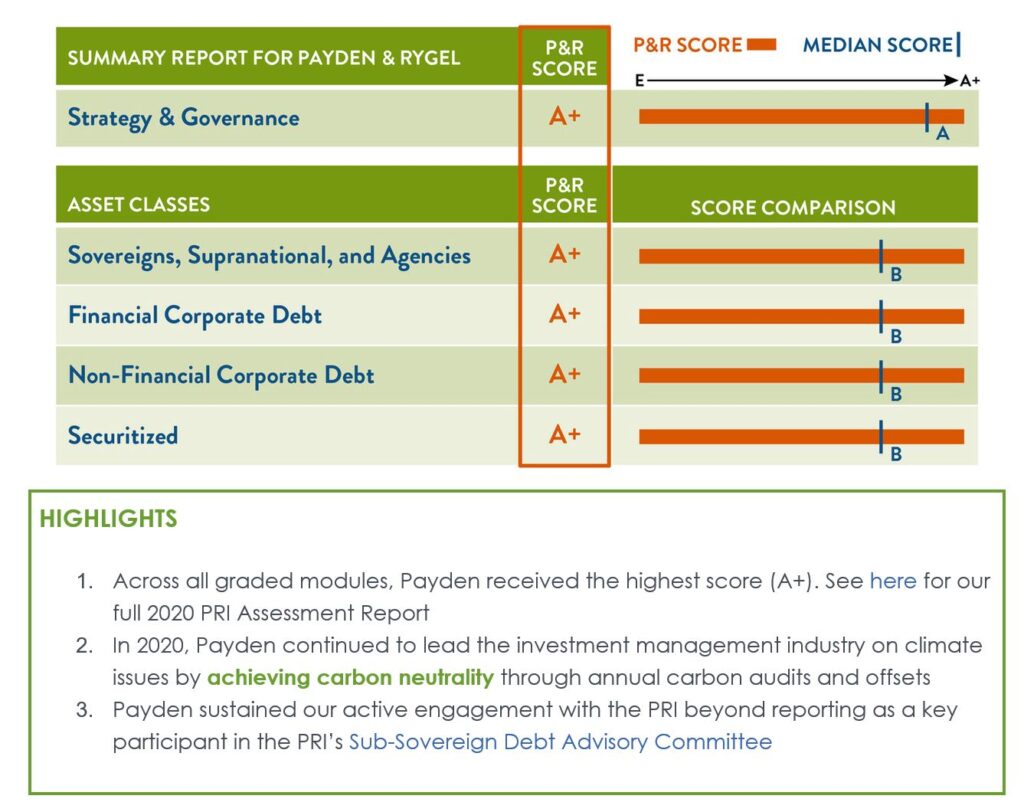

Payden & Rygel has been a signatory to the UN Principles for Responsible Investment (PRI) since 2013. In five years of reporting across all fixed income modules, it has received A+ on all; most recently the Task Force on Climate

related Financial Disclosures (TCFD).

Payden & Rygel:

- Is one of a small number of asset managers in the SASB Alliance, integrating SASB standards in the investment Is an active buyer of green and social bonds across both ESG and standard client mandates ( ($1.1B in exposure firm-wide)

- Manages large mandates with explicit ESG objectives across the fixed income universe

- Is a member of PRI’s Sovereign and Sub Sovereign select working groups on global ESG materiality frameworks

- Has published white papers in 2019 and 2020

- Is an investor signatory to the Carbon Disclosure Project (CDP)

- Has recently implemented a firm-wide tobacco and related product exclusion policy

- Has developed and launched a dedicated social impact strategy focusing on US municipal market.

In the future, Payden & Rygel plans to:

- Work toward a firmwide carbon neutral stance (carbon audit + offset) expected by YE 2020

- Work on developing scenario analysis capabilities around climate-related targets and metrics

- Continue expansion of ESG resources, integration tools and team.