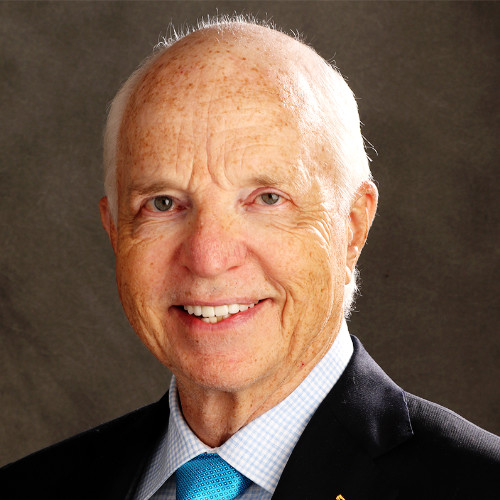

GSFM’s Investment Strategist, Stephen Miller speaks to Eric Souders, Portfolio Manager for the Payden Global Income Opportunities Fund. They delve into the defining characteristics of absolute return bond funds compared to traditional bond funds and discuss the strategic positioning of the Payden Global Income Opportunities Fund in the current economic climate.

Eric explains that absolute return bond funds aim to achieve two primary objectives: delivering an absolute return over shorter time horizons (typically 12-18 months) and targeting cash returns plus a specific spread over medium-term periods (3-5 years). These funds operate without being tethered to a benchmark but still maintain certain constraints, such as an investment-grade portfolio rating. Eric also highlights the fund’s unconstrained nature, which allows flexibility in optimizing duration and credit exposure based on prevailing macroeconomic conditions. They touch on recession prospects, portfolio adjustments, risk management, and how absolute return bond funds can be a valuable addition to a diversified investment portfolio.

Chapters will appear when you click through to watch on YouTube